The Definitive Guide to Chapter 13 Discharge Papers

4 Simple Techniques For Obtaining Copy Of Bankruptcy Discharge Papers

Table of ContentsGetting The How Do You Get A Copy Of Your Bankruptcy Discharge Papers To WorkThe Ultimate Guide To Copy Of Chapter 7 Discharge PapersNot known Incorrect Statements About Copy Of Bankruptcy Discharge Little Known Questions About Obtaining Copy Of Bankruptcy Discharge Papers.Copy Of Bankruptcy Discharge Fundamentals Explained

Attorney's are not needed to maintain insolvency filings. This does rely on each attorney. The Discharge records are totally free if the personal bankruptcy discharged much less than 30 calendar days from today if bought on this web site. "Free Bankruptcy Documents"A. All Firm as well as Service Data, might be gotten by calling the U.S.A. Personal bankruptcy records make use of to be maintained indefinitely up until 2015. Laws have actually now changed to maintain personal bankruptcy data for just 20 years. This has actually created a trouble, with what is refereed to as "zombie" debt. Go to the credit scores page. A. If you file insolvency, It ends up being public document, as well as will certainly remain in the "public document" section of your credit scores record.

If you filed insolvency in 2004 or prior, your documents are limited, and might not be readily available to get digitally. Call (800) 988-2448 to check the availability prior to ordering your documents, if this uses to you.

Top Guidelines Of Bankruptcy Discharge Paperwork

U.S. Records fee's to aid in the access procedure of acquiring bankruptcy paperwork from NARA, relies on the time involved and cost involved for united state Records, plus NARA's costs The Docket is a register of basic info throughout the personal bankruptcy. Such as condition, case number, filing and also discharges days, Attorney & Trustee information.

If you're late paying the tax obligation, keep the return 2 years from the day you paid or 3 from when you submitted (whichever is later). When it pertains to receipts, if there's a service warranty, maintain the invoice till the guarantee runs out. Or else, for anything you may need to reclaim, simply keep the invoice up until the return duration is up.

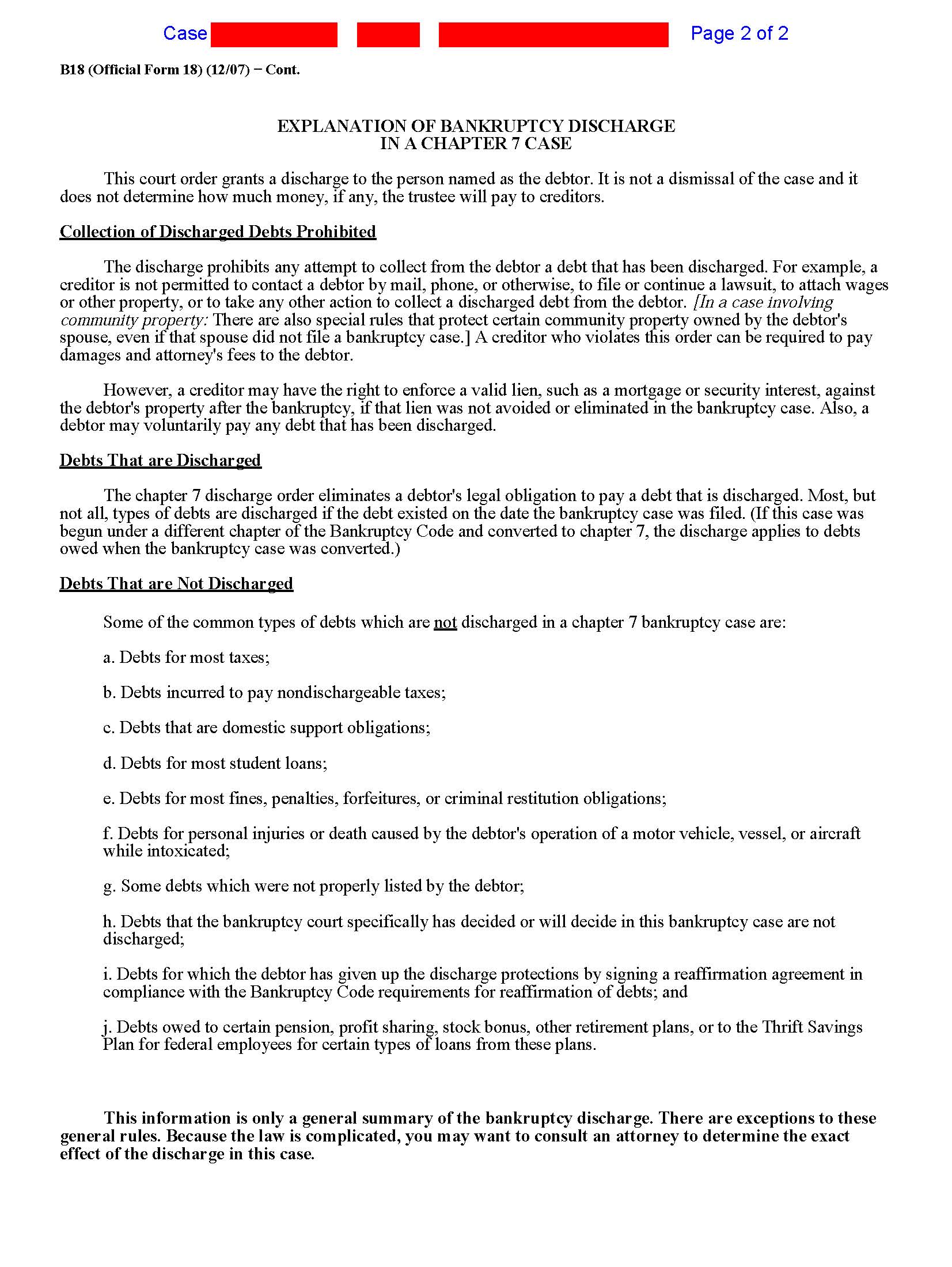

Despite the fact that your personal bankruptcy petition, papers, and discharge feel like economic documents that could drop under the exact same timeline as your tax docs, they are NOT (how to get copy of bankruptcy discharge papers). They are much more vital and must bankruptcy discharge paperwork be maintained forever. Financial institutions might come back and try to accumulate on a financial debt that was part of the personal bankruptcy.

Some Known Details About Copy Of Bankruptcy Discharge

Additionally, creditors liquidate uncollectable bill in portions of thousands (or thousands of thousands) of accounts. Uncollectable bill buyers are commonly aggressive as well as dishonest, as well as having your insolvency records on-hand can be the fastest means to shut them down and maintain old things from popping back up on your credit scores record.

Obtaining copies of your personal bankruptcy files from your attorney can take time, especially if your case is older and the copies are archived off-site. Obtaining insolvency files from the Federal courts can be pricey as well as time-consuming.

Maintain every web page - https://www.businessfollow.com/author/b4nkrvptcydcp/. Get a box or large envelope and placed them all inside. It's much better to save as well a lot than insufficient. Put them in a refuge, as well like where you maintain your will certainly as well as other crucial monetary records and simply leave them there. If you never require them, excellent.

The How Do You Get A Copy Of Your Bankruptcy Discharge Papers Diaries

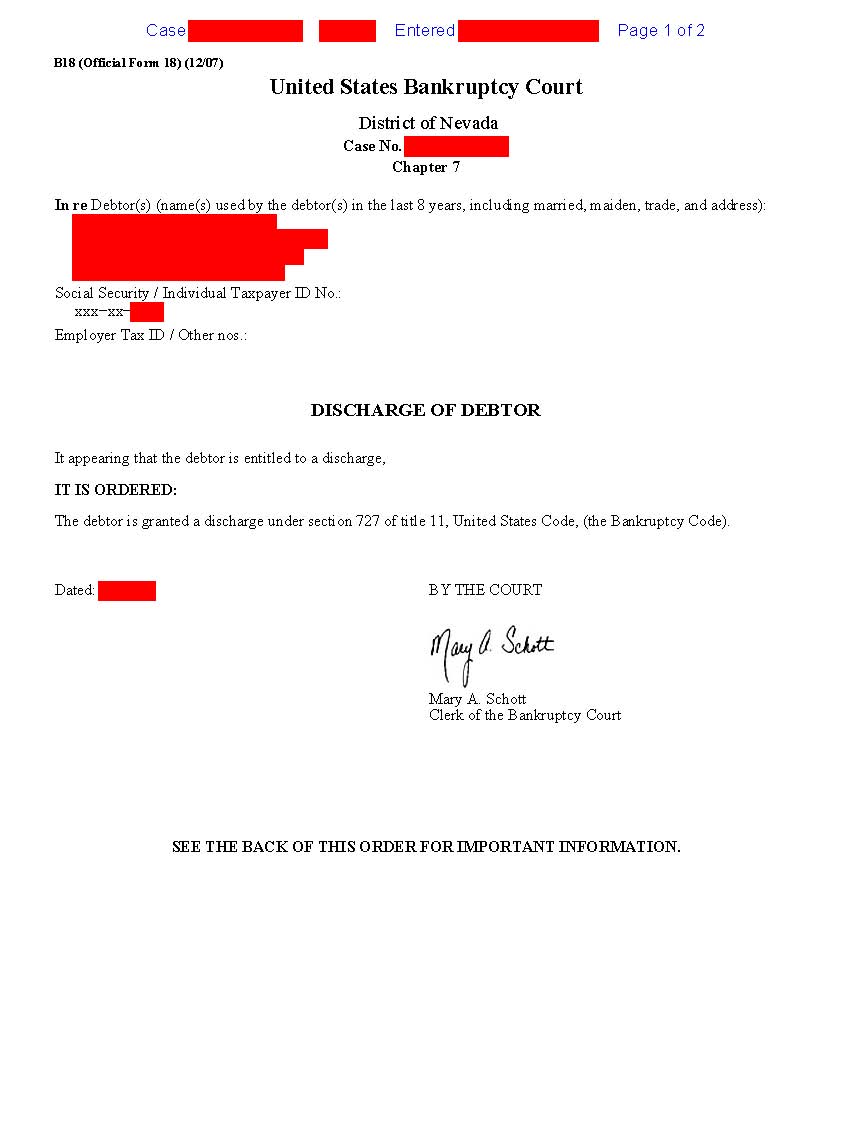

A discharged financial debt essentially goes away. Financial obligations that are likely to be released in an insolvency proceeding consist of credit report card debts, medical bills, some claim judgments, personal car loans, obligations under a lease or other agreement, as well as other unsafe financial debts.

You can't merely ask the insolvency court to release your financial debts due to the fact that you do not desire to pay them. You need to finish all of the requirements for your bankruptcy case to receive a discharge.

Bankruptcy Trustee, as well as the trustee's attorney. The trustee directly manages your insolvency situation.

Get This Report about How To Obtain Bankruptcy Discharge Letter

You can file a movement with the personal bankruptcy court to have your case resumed if any kind of lender tries to collect a released debt from you. The financial institution can be fined if the court establishes that it violated the discharge order. You can attempt just sending a duplicate of your order of discharge to quit any collection task, and afterwards chat to an insolvency lawyer regarding taking legal action if that doesn't work.

The trustee will liquidate your nonexempt possessions as well as split the profits amongst your financial institutions in a Phase 7 insolvency. Any financial obligation that stays will be released or erased. You'll enter right into a repayment plan over 3 to 5 years that repays all or the majority of your financial obligations if you declare Chapter 13 protection.